March 2025

Market specific information

Significance for Azerbaijan

Poland is an important source market for Azerbaijan’s tourism industry, offering a growing number of travellers interested in cultural exploration, nature, and affordable travel experiences. With Polish tourists prioritizing cost-effectiveness and quality, Azerbaijan’s rich history, diverse landscapes make it an attractive destination. The increasing preference for cultural and gastronomical tourism among Polish visitors aligns well with Azerbaijan’s unique heritage and cuisine.

Main holiday periods

- Winter Holidays

- End of April – Easter time

- May – 1, 3

- July – August – The summer period (school holidays)

- Christmas – New Year – End of December

Tourist Information

Profile of the tourist

Polish travellers encompass a wide range of ages, with notable segments including singles and childless couples, families with children, and seniors aged 60-75. Singles and childless couples often embark on vacations 2-4 times annually, favoring passive relaxation. Families with adult children lean towards active holidays, while seniors typically travel with partners, preferring organized trips.

Holiday types

- Sun & Beach Holidays: Highly popular across all age groups, with 61% overall showing interest. The strongest preference is seen among those aged 55-64 (76%), followed by younger travellers aged 18-24 (58%) and 35-44 (57%). For beach holidays, Polish travellers typically choose Spain, Italy, Türkiye, and Egypt.

- Cultural & Gastronomical Holidays: A top choice for travellers of all ages, with 49% overall preferring these experiences. Interest increases with age, peaking at 64% among those aged 55-64.

- Adventure and Sports Holidays: Nature and adventure activities, such as kayaking and trekking, attract 36% of travellers overall, with the highest interest among those aged 25-34 (46%). Sporting activities like surfing and cycling are less popular, with 19% of travellers engaging in them, especially among the 25-34 age group.

- Shopping: A significant part of travel experiences, with 27% of travellers showing interest. The highest participation is among those aged 35-44 (39%) and 45-54 (38%).

- Wellness and Medical Tourism: Less prominent compared to other travel motivations, with 12% overall engaging in wellness activities like yoga and spa treatments. Interest is highest among travellers aged 45-54 (19%).

- Hiking Holidays: Growing in popularity, especially among nature enthusiasts and active travellers. Around 30% of Polish tourists show interest in hiking, with the highest engagement among those aged 25-44. Popular destinations include the Tatra Mountains, the Alps, and the Carpathians.

Preferences

- Affordability: A significant 65% of Polish travelers prioritize cost-effectiveness when selecting holiday destinations, surpassing the global average of 58%.

- Recommendations: Personal endorsements influence 51% of Polish tourists, highlighting the importance of word-of-mouth and social networks.

- Safety and Security: Stable and secure environments are paramount in destination selection.

- Comfort and Quality: High-quality accommodation and services are favored, with many organizing trips independently to ensure personalized experiences.

Average Spending

In 2024, Polish tourists showed a growing preference for high-quality accommodations, with over 37% choosing five-star hotels and more than 85% opting for all-inclusive packages. Despite these upscale choices, the average vacation cost per person slightly decreased from the previous year. With rising average wages, holidays became relatively more affordable.

Key travel audience

● Families

● Couples

● Friends’ groups

Information source

- Social Media (Instagram, Facebook for Millennials and Gen Z)

- Friends’ recommendations (Word of Mouth)

- Travel agencies

- Online travel agencies (OTAs)

- Online Travel Communities and Forums

- TV: TVN, Polsat, TVP

- Radio: Polskie Radio, RMF FM, Radio Zet

- Newspapers: Gazeta Wyborcza, Rzeczpospolita

- Online Media: Onet.pl, WP.pl, Interia.pl

Planning and travel decision period

Polish travelers typically book vacations 3-6 months in advance, but timelines vary:

- Summer holidays are usually booked between January and April.

- Winter and New Year trips are planned 3-4 months ahead, with bookings from September to November.

- Short city breaks and weekend getaways are often booked 1-2 months in advance.

- Last-minute bookings (2-4 weeks prior) are common, especially for discounted deals and spontaneous trips.

Means for purchase

- 51% of travel arrangement in Poland is by self-arrangement

- 33% of travel arrangement in Poland is by travel agencies/tour operators

- 15% of travel arrangement in Poland is by both self & travel agencies/tour operators

Distribution system

- Online travel agencies (OTAs): eSky, Wakacje, Rainbow

- Specialized providers: Hotels.com, Booking.com, Airbnb

- Most visited travel and tourism websites: Booking.com, Wakacje.pl, Skyscanner.pl

Travel duration

Polish travellers, especially during the summer months, tend to take longer vacations, ranging from 7 to 14 days. Destinations are often within Europe, particularly for beach holidays in Southern European countries like Spain and Greece. The average duration for off-peak season trips (like spring or autumn) is around 5 to 7 days. This is in line with typical travel durations for shorter breaks outside the peak holiday season. Polish family vacations, especially during holidays such as Christmas or New Year’s, typically last 5 to 10 days.

Travel trade information

List of leading tourism companies:

- Anex Poland (Orex Travel Sp.)

- Join up!

- TUI Poland

- Coral Travel/ Wezyr Holidays

- EXIM Tours

- ITAKA Poland

- Rainbow

Direct flights

Updated information about flight connectivity can be found on the interactive board of the State Tourism Agency of the Republic of Azerbaijan.

Major events in the market

- TT Warsaw each November

- ITTF Warsaw each April

Polish tourists in Azerbaijan: Key insights

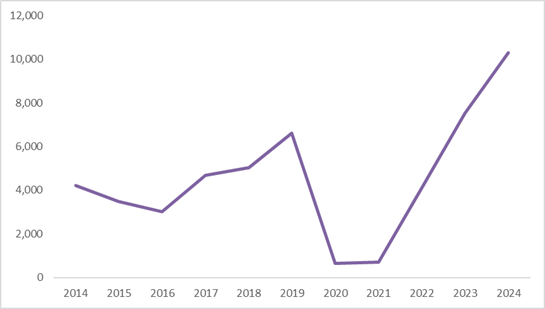

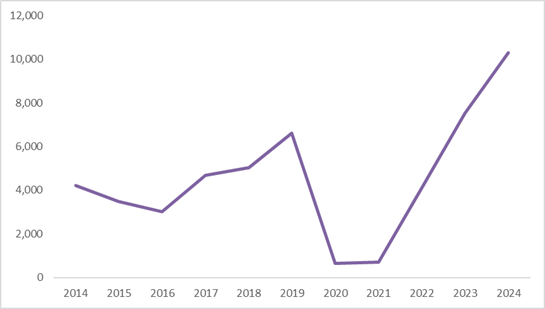

The number of Polish arrivals to Azerbaijan increased steadily from 4,209 in 2014 to 6,612 in 2019, representing an overall growth of approximately 57% over this period.

From 2020 to 2021, the numbers dropped significantly due to the COVID-19 pandemic. However, from 2022 to 2024, the numbers began to recover, with a growth of 82.5% in 2022 and 82.7% in 2023 compared to the previous year, indicating a strong recovery trend and surpassing pre-pandemic levels.

Source: State Migration Service

Purpose of Visit

Azerbaijan for Polish tourists is primarily a leisure destination, with 75% of visitors attracted by its culture and scenery. Business travel also plays a key role, making up 18% of visits, reflecting Poland’s growing commercial appeal. While fewer people visit for family, shopping, or other reasons, these still add to the overall mix.

Average Spending

In Poland, the average spending per tourist is distributed as follows: 10.5% is spent on purchasing gifts and souvenirs, 41.2% on transportation, 19.5% on feeding (meals), 23.7% on accommodation, and 5.2% on other miscellaneous expenses. In total, the average expenditure per tourist amounts to 1,758.5 AZN in 2024.

Length of Stay

In 2024, most visitors (44%) stayed for 1-3 nights, while 34% opted for stays of 4-7 nights.

Popular Regions

Excluding Baku, the top regions for Polish tourists in Azerbaijan are Quba, Qusar, and Gabala. Ganja also attracts a good number of visitors.

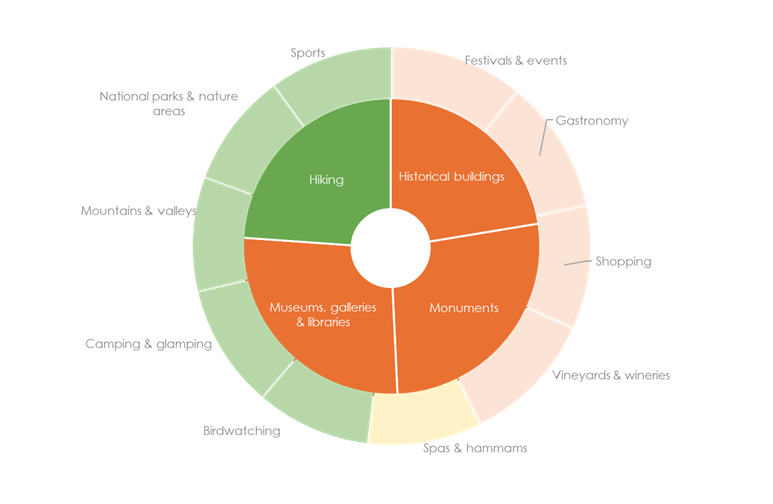

Tourist Preferences and Interests

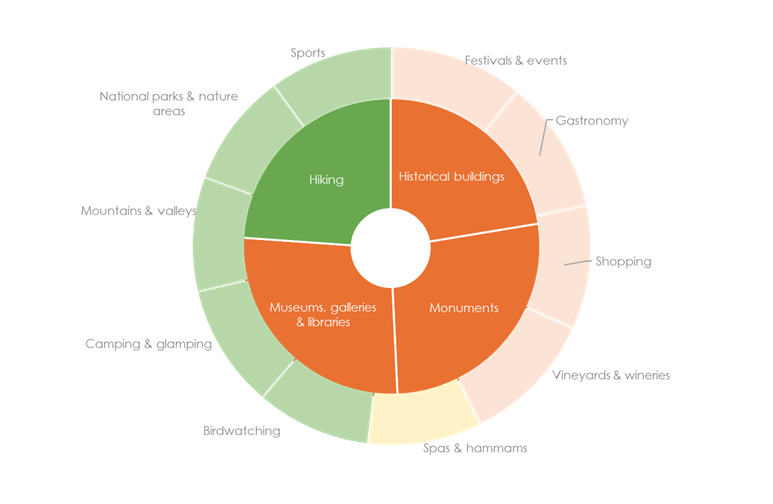

Polish tourists exhibit a strong preference for a variety of cultural and natural experiences connected to the ATB product sub-categories of historical buildings, monuments, museums, galleries & libraries, theatres, cultural & opera houses, and hiking.

Products of Azerbaijan that connect to the Poland market can be grouped into “Fits all” – products that all first-time visitors should see or experience, “Add-ons” – products that can be seen or experienced with longer or repeat visits, and “Tailored” – products that are considered of specific relevance to the market.

|

|

Fits all

|

Add-ons

|

Tailored

|

|

Monuments

|

- Haydar Aliyev Centre

- Maiden Tower

- Diri Baba Mausoleum

- Ateshgah fire temple

- Flame Towers

|

|

|

|

Historical Buildings and Sites

|

- Gobustan petroglyphs

- Baku Old City

- Kish Alban Church

- Sheki Khans Palace

- Sheki Khans Mosque & Cemetery

- Sheki Upper Caravanserai

|

- Yanardag burning mountain

|

- Baku City Hall

- Ismailiyya Palace

- Palace of Happiness

- Street of Polish architects

- Grave of engineer Pavel Potocki

|

|

Hiking

|

- Shahdag National Park hiking trails

- Hirkan lakeside walks & local chaykhanas

|

- Goygol National Park Mountain lakes hiking trails

|

- Trans Caucasus Trail

- Laza-Laza hiking trail

|

|

Museums, Galleries & libraries

|

- Heydar Aliyev Center

- Shirvanshah Museum

- Carpet Museum

- National History Museum

- Gobustan Mud Volcano Centre & Museum

|

|

|

|

Ethnic & Cultural Villages

|

- Sheki old city (national heritage)

- Khinalig village (Caucasian-Albanian)

- Nij village (Udi / Caucasian-Albanian)

|

- Basqal village (national heritage)

- Sim village (Talish)

- Ivanovka village (Russian Molokan)

- Red village (Mountain Jews)

|

|

|

Arts & Crafts

|

- Carpet weaving masterclass

- Lahij coppersmith masterclass

- Sheki Shebekhe masterclass

|

- Mugham centre performance

|

|

Additional information

Top tips for the Polish market

- Relationship management is crucial; building loyalty with Polish wholesalers and travel agencies is key. Long-term partnerships are valued. Personal connections matter—frequent engagement and reliability help build trust.

- The ideal period for outreach is April to July before peak summer bookings. A secondary outreach window is September to November, when Polish agencies plan for winter and New Year travel packages.

- Email is preferred for initial and follow-up communications. Face-to-face meetings are highly valued, especially during trade shows and B2B networking events. Virtual meetings and video calls are also accepted. Ensure all communication is clear, professional, and punctual.

- Key market centres to visit are Warsaw, Kraków, Poznań, Wrocław, Gdańsk and Katowice.

https://www.visitbritain.org/research-insights/inbound-markets/poland?utm_source=chatgpt.com#how-we-source-information

file:///C:/Users/sabina.i/Downloads/visitbritain_marketprofile_poland-1.pdf

https://tgmresearch.com/docs/travel-survey-2023/tgm-global-travel-report-2023_poland.pdf?cmid=6aad0715-c225-9e79-5037-9b7395b85dd9

https://turystyka.rp.pl/biura-podrozy/art40278371-ranking-biur-podrozy-2024-dwaj-liderzy-na-czele-itaka-holdings-i-tui-poland

http://www.wczasopedia.pl/index.html

https://pit.org.pl/wp-content/uploads/2024/09/Zagraniczne-wakacje-Polakow-2024_4.09.pdf